31 October 2024

Elia publishes CRM auction results: guaranteed security of supply for 2025-2026 and major progress made regarding 2028-2029

BRUSSELS | System operator Elia has published the results of the Capacity Remuneration Mechanism (CRM) auctions. For the first time, two auctions were held simultaneously, namely the last auction (Y-1) for the 2025-2026 delivery year and the first auction (Y-4) for the 2028-2029 delivery year. For the 2025-2026 delivery year, the goal has been achieved: security of supply is guaranteed and sufficient volume has been contracted. For the 2028-2029 delivery year, an important first step has been taken. Both auctions were conducted correctly. The regulator has checked and validated the results.

Key conclusions following the Y-1 auction for the 2025-2026 delivery year

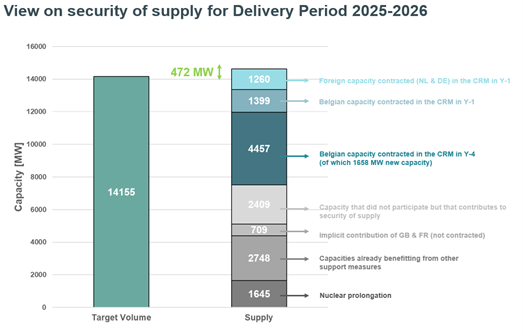

- Security of supply for the 2025-2026 period is guaranteed: 14,627 MW of capacity will be available in the system, while the CRM assumed that 14,155 MW would be needed.

- The first time foreign capacity participated in the CRM was a success, with 1,260 MW of foreign capacity selected (976 MW from the Netherlands and 284 MW from Germany).

- The Y-1 auction had high liquidity and was competitive: the volume offered (3,131 MW) exceeded demand by 472 MW and the weighted average price of €15.7k/MW/year was well below the intermediate price cap of €27.3k/MW/year.

- The total cost of the CRM for the 2025-2026 delivery year is approximately €182.9 million or around €25.7k/MW for the volumes contracted within the mechanism.

Supply exceeds demand in the Y-1 auction

The initial demand curve for the Y-1 auction was set by the minister at 4,596 MW. Following corrections during the auction process, this was adjusted to 2,658 MW. Corrections are made either downwards (by subtracting volume that is not eligible or does not wish to participate from the demand curve) or upwards (volume that wants to participate and so renounces any other subsidies, for instance). 38 units participated in the auction itself, offering a total capacity of 3,131 MW.

As such, supply exceeded demand. 31 units were selected, offering a total capacity of 2,659 MW. These comprise 2,314 MW of existing capacity (1,260 MW of which comes from abroad), 41 MW of refurbished capacity and 304 MW of capacity already contracted in the Y-4 auction in 2023 but that will contribute to security of supply sooner.

Goal achieved: the CRM auctions for 2025-2026 ensure sufficient capacity for security of supply

The Y-1 auction for 2025-2026 is the final element of the auctions for winter 2025-2026. The need for capacity, based on peak consumption, was 14,155 MW. 14,627 MW of capacity will be available in the system:

- 7,116 MW is contracted through the CRM (both Y-4 and Y-1 auctions).

- 2,409 MW chose not to participate in the CRM but is expected to be present in the system and so contribute to security of supply.

- 3,457 MW was not eligible to take part or was implicitly included (contributions from the UK)

- 1,645 MW came from expanded nuclear capacity.

Key conclusions following the Y-4 auction for the 2028-2029 delivery year

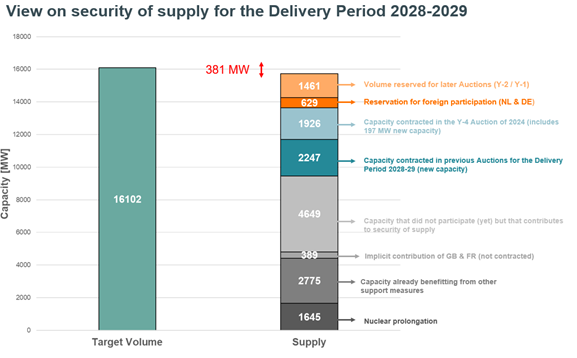

- An important step has been taken towards ensuring security of supply in the 2028-2029 period.

- 1,926 MW of capacity was contracted in this Y-4 auction.

- Together with the volume already contracted in previous auctions for this delivery year, 4,173 MW has already been contracted, 2,444 MW of which is new capacity (1,617 MW from CCGTs, 572 MW from batteries, 246 MW from refurbished OCGTs and 9 MW from gas engines), and 246 MW coming from demand-side management.

- Batteries continue to play an ever-greater role: like last year, a significant volume of new batteries (188 MW derated, approximately 500 MW installed) was contracted in this Y-4 auction.

- A net volume of 381 MW was transferred to the Y-2 and Y-1 auctions due to the lower liquidity on offer. Currently, the prospects of finding these volumes in the future Y-2 and Y-1 auctions for winter 2028-2029 are reassuring.

- Despite the lower liquidity, the weighted average price (€28.0k/MW/y) is significantly lower than at last year's auction (€36.4k/MW/y).

A major first step

The volume for the Y-4 auction for the 2028-2029 delivery year was set by the minister at 6,957 MW.

Following corrections during the auction process, this was adjusted to 2,307 MW. Corrections are made either downwards (by subtracting volume that is not eligible or does not wish to participate, accounting for 5,458 MW in this auction) or upwards (volume that wants to participate and so renounces any other subsidies, for instance, accounting for 808 MW here). 30 units participated in the auction itself, offering a total capacity of 1,926 MW. As the demand curve was higher than the supply, all projects were contracted. This comprised 1,329 MW of existing capacity, 197 MW of new capacity and 399 MW of refurbished capacity. Among other things, 188 MW of new batteries and 246 MW of demand-side management were contracted. The volume carried over to subsequent auctions takes into account the dynamic correction concerning demand-side management. This will transfer 381 MW to the following auctions.

Two more auctions to go

Two further auctions are scheduled for the 2028-2029 delivery year, namely a Y-2 and a Y-1 auction. These auctions typically involve technologies that have a shorter development time. For each of these auctions, the volume needed to guarantee security of supply will also be further refined.

Elia assumes that these volumes will be found in these auctions. A lot of projects declared their interest at the start of the process but did not appear ready to move forward. This could be due to missing permits or technical ambiguities that still need to be clarified. These included battery projects and demand-side management.

What is the CRM again?

The CRM was set up to guarantee the supply of electricity following the partial nuclear phase-out (from 2025 onwards). This financial support is geared towards market players to make capacity available to guarantee security of supply and who do not receive any other subsidies regarding said capacity. In consultation with the European authorities, the Belgian government has opted for a market-wide CRM. This means that both existing and new capacity are eligible, as is any type of technology (e.g. thermal power plants, batteries, demand-side management). In the selection procedure, the price offered is the decisive factor. The volume to be auctioned is decided by the Federal Minister for Energy based on a proposal from CREG on the basis of the scenario selected by the minister and calculations by Elia.

There are multiple auctions for each delivery year, with one held four years in advance (Y-4) and one held one year in advance (Y-1). Moreover, in the near future a Y-2 auction will also be organised for volumes to be available two years later. This must allow the market to make sufficient preparations, but also helps to refine the volumes to be auctioned at different times and facilitates the participation of different technologies with different needs in terms of development time.

Press releases

-

Elia publishes CRM auction results: guaranteed security of supply for 2025-2026 and major progress made regarding 2028-2029PDF - 420.16 KB

-

Elia publie les résultats des enchères CRM : sécurité d’approvisionnement garantie pour la période 2025-2026 et étape importante franchie pour la période 2028-2029PDF - 360.69 KB

-

Elia publiceert resultaten CRM-veilingen: bevoorradingszekerheid voor 2025-2026 is verzekerd en een belangrijke stap voor 2028-2029 is gezetPDF - 500.35 KB